Choosing the right account type can make all the difference in your trading experience. HF Markets (HFM), one of South Africa’s leading forex and CFD brokers, offers a variety of account types designed to meet the needs of different traders. In this post, we’ll provide a comprehensive breakdown of all the HFM account types available in South Africa.

What is HFM (HF Markets) and How Does It Work in South Africa?

HF Markets (previously known as HotForex) is an online platform where people can trade financial products like currencies, stocks, commodities, and cryptocurrencies.

It’s one of the biggest forex brokers in the world, and it’s available to traders in South Africa. This means anyone from South Africa can sign up, start trading, and try to make a profit based on the changes in market prices.

Traders all over the world are currently recommending HF Markets (HFM). It is one of the best Forex brokers for beginners and even advanced traders at the moment because of its user-friendly interface, and ability to trade forex, crypto, commodities, stocks, indices, etc.

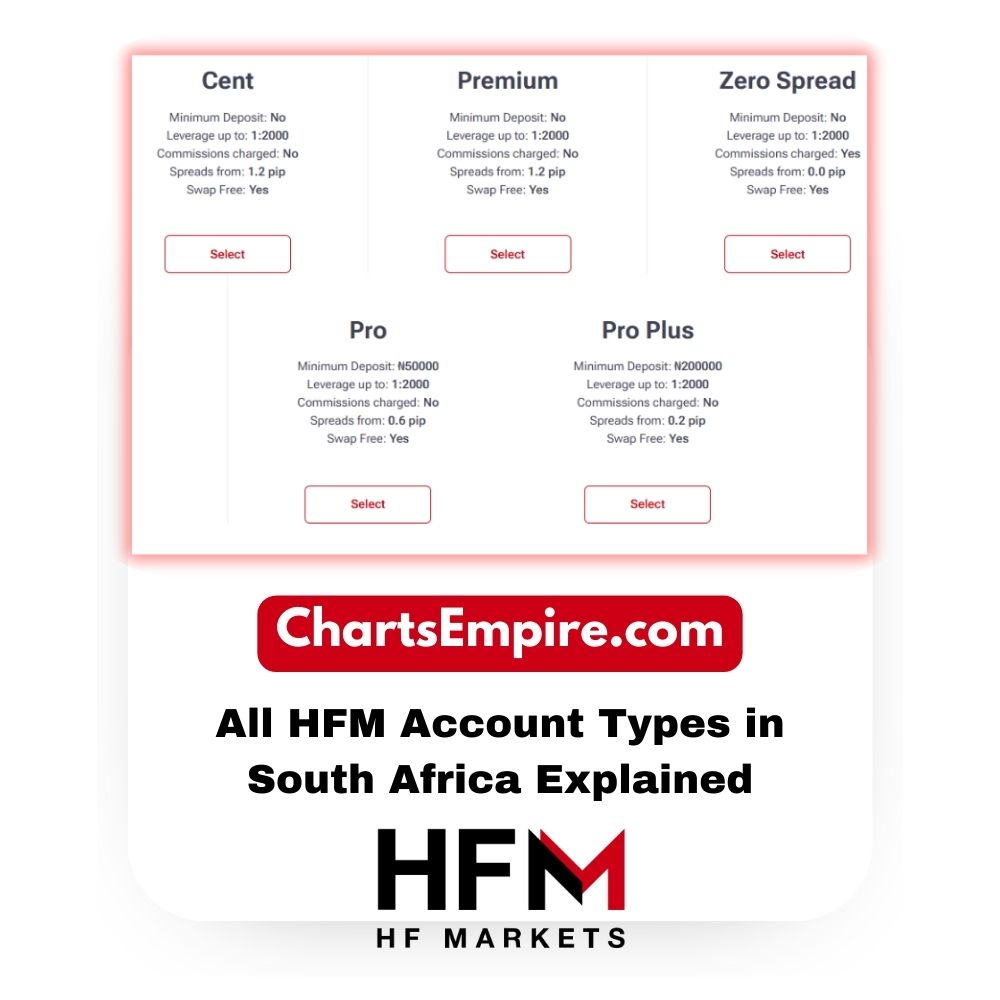

Overview of HF Markets Account Types Available in South Africa

HF Markets (HFM) offers several types of trading accounts, each designed to cater to different types of traders in South Africa. If you’re a beginner or a seasoned pro, there’s an account for you. Below is a clear and straightforward breakdown of each HFM account type so you can choose the one that fits your needs.

1. Cent Account – Great for Beginners

The HFM Cent Account is perfect if you’re new to forex trading. It allows you to trade with smaller amounts of money and lower risk, making it ideal for practice and learning.

Key Features:

- Spreads: From 1.2 pips.

- Minimum Deposit: Just $0.

- Leverage: High leverage up to 1:2000, so you can control bigger positions with a smaller deposit.

- Trade Size: You can start with as little as 0.01 lot.

- Trading Instruments: You can trade forex and gold.

- Commission: No commission on forex trades.

- Platform Access: Available on MetaTrader 4, MetaTrader 5, WebTrader, and HFM Platform.

For new traders in South Africa, this account type offers a low-risk entry point into the world of forex trading. It’s also great for testing strategies with minimal funds.

2. Zero Account – Best for Active Traders

The HFM Zero Account is ideal for those who want to trade with low spreads. If you’re an active trader who makes a lot of trades throughout the day, this is a great choice.

Key Features:

- Spreads: From 0 on forex and gold.

- Minimum Deposit: $0 or R0.

- Leverage: Up to 1:2000, giving you a chance to control larger trades.

- Trade Size: Start with 0.01 lots.

- Trading Instruments: You can trade forex, commodities, stocks, and cryptos.

- Commission: Yes, there’s a small commission on forex pairs.

- Platform Access: Available on MetaTrader 4, MetaTrader 5, WebTrader, and HFM Platform.

With zero spreads on forex and gold, this account type is designed for traders who focus on short-term profits from small price movements. It’s great for traders in South Africa who need low-cost trading options.

3. Pro Account – Perfect for Experienced Traders

The HFM Pro Account is a step up for traders who want more advanced features and better flexibility. It’s designed for those who are comfortable with higher risk and want to take advantage of higher leverage and tight spreads.

Key Features:

- Spreads: From 0.5 pips.

- Minimum Deposit: $100 or R1,800.

- Leverage: Up to 1:2000.

- Trade Size: Start with 0.01 lot.

- Trading Instruments: Full access to forex, commodities, stocks, and cryptos.

- Commission: Yes, there’s a commission on forex trades.

- Platform Access: Available on MetaTrader 4, MetaTrader 5, WebTrader, and HFM Platform.

The Pro Account is for traders in South Africa who have more experience and want the flexibility to trade a wide variety of instruments. This account type is great for those who want to trade in volatile markets and take advantage of tight spreads.

4. Pro Plus Account – For Professional Traders

The HFM Pro Plus Account is aimed at professional traders who need even tighter spreads and higher leverage. If you’re an advanced trader looking for the best conditions to execute large trades, this is the account type for you.

Key Features:

- Spreads: From 0.2 pips.

- Minimum Deposit: $250 or R4,700.

- Leverage: Up to 1:2000.

- Trade Size: Start with 0.01 lots.

- Trading Instruments: You can trade forex, commodities, stocks, cryptos, and more.

- Commission: Yes, commission applies on forex trades.

- Platform Access: Available on MetaTrader 4, MetaTrader 5, WebTrader, and HFM Platform.

The Pro Plus Account gives professional traders in South Africa access to the best spreads and more favorable trading conditions for high-volume trading. If you’re looking for superior execution speeds and minimal cost, this is the account for you.

5. Premium Account – Ideal for VIP Traders

The HFM Premium Account is designed for VIP traders who want the best possible service and access to premium features. This account type is perfect if you want to trade with advanced tools and get personalized support.

Key Features:

- Spreads: From 1.2 pips.

- Minimum Deposit: $0 / R0.

- Leverage: Up to 1:2000.

- Trade Size: 0.01 lot minimum.

- Trading Instruments: Access to all available instruments.

- Commission: No commission on forex pairs.

- Platform Access: Available on MetaTrader 4, MetaTrader 5, WebTrader, and HFM Platform.

For VIP traders in South Africa, this account gives you a premium trading experience with personal account management, flexible bonuses, and extra trading tools.

1. HFM Cent Account in South Africa

The HFM Cent Account is designed for beginner traders or those who want to start small without risking a large amount of capital. If you’re just starting out in forex trading or want to practice your skills without significant financial exposure, this account type could be a great fit for you.

Let’s see how the HFM Cent Account works in real-life trading scenarios.

1. Spread Type: Variable

The HFM Cent Account offers variable spreads.

A spread is the difference between the buy and sell price of a trading asset. Since this account uses variable spreads, the spread may change depending on market conditions, but it generally starts from 1.2 pips.

In real-life trading, a 1.2-pip spread is relatively small for a beginner account. This means you’ll pay a bit more in trading costs when entering and exiting the market, but it’s still manageable for those just starting out in the world of forex.

2. Account Currency: USC (United States Cent)

The HFM Cent Account is denominated in USC (United States Cent), meaning that every 1 cent in this account equals 1/100th of a US dollar.

In practical terms, this makes the account more beginner-friendly. If you deposit $100, you will actually be trading with 10,000 USC. This system allows new traders to get more familiar with the trading process without risking large amounts of money.

For example, a 10,000 USC deposit allows you to practice trading with lower value positions compared to a standard account. This is ideal if you’re still learning the ropes of forex trading and want to reduce risk while building confidence.

3. Minimum Deposit: $0

One of the most attractive features of the HFM Cent Account is its $0 minimum deposit.

This means you can open an account with HFM without needing any initial capital. This is a great opportunity for new traders in South Africa who want to explore trading but may not have a lot of funds to start with. You can open the account and begin practicing with demo trading or small deposits.

In real-life trading, a $0 deposit makes it possible to test out the platform and start trading without risking any of your own money at first. You can practice and get a feel for how the market moves before committing more funds.

4. Trading Instruments: Forex & Gold

With the HFM Cent Account, you can trade forex pairs and gold.

For example, you might trade USD/ZAR, which is popular among South African traders, or buy and sell gold. These are both highly liquid markets, meaning there’s plenty of trading activity and movement to potentially profit from.

For a beginner in South Africa, this is a great starting point. You can focus on forex pairs for quick trades or gold as a safe-haven asset when markets are uncertain.

5. Maximum Leverage: 1:2000

The HFM Cent Account offers a maximum leverage of 1:2000, which means you can control a larger position with a smaller deposit.

In simple terms, leverage lets you multiply your trading position. For example, with $1 in your account, you can control a position worth $2,000. However, while leverage increases your profit potential, it also increases your risk.

In real-life trading, 1:2000 leverage means you can enter bigger trades with a small deposit. If you’re a beginner, this can be a double-edged sword. You could potentially make larger profits, but it also means you risk more money. It’s important to use risk management tools like stop-loss orders when using high leverage.

6. Minimum Trade Size: 0.01 Lot

The HFM Cent Account allows you to trade in small amounts with a minimum trade size of 0.01 lot.

In practical terms, this means you can start with small positions and test your strategies before scaling up. 0.01 lot is the smallest trade size available, and it’s ideal for beginners who want to start with very low risk.

For example, if you’re trading the EUR/USD pair with a 0.01 lot size, your profit or loss would be very small, making it an ideal way to practice without risking too much. This is perfect for new traders in South Africa looking to get their feet wet without committing a large amount of capital.

7. Stop Out Level: 20%

The stop-out level for the HFM Cent Account is set at 20%.

This means that if your account balance falls below 20% of the margin required for your open positions, HFM will automatically close your trades. This is to protect you from further losses.

In real trading, if the market moves against you and your balance gets too low, the stop-out level kicks in to prevent your account from going into negative equity. For beginners, this is a useful feature to avoid the risk of losing more money than you initially deposited.

8. Margin Call: 50%

The margin call level for the HFM Cent Account is 50%.

When your account balance reaches 50% of the margin required to keep your trades open, HFM will notify you to add more funds or close your positions. This is to give you a chance to act before the stop-out level is triggered.

For example, if your account balance starts to drop because the market is moving against your position, you’ll get a warning when it reaches 50% of the required margin. This gives you time to either deposit more funds or reduce your positions.

9. Max Simultaneous Open Orders: 150

The HFM Cent Account allows you to open up to 150 orders simultaneously.

This gives you the flexibility to trade a variety of forex pairs, such as USD/ZAR, or even gold, without worrying about hitting a limit on how many trades you can manage.

For beginner traders, this means you can experiment with different strategies or trade several markets at the same time to diversify your positions.

10. Swap-Free Option

The HFM Cent Account is swap-free.

A swap is the interest you pay or receive for holding a position overnight. For those who want to avoid swap fees (common in Islamic finance or for traders who don’t want overnight charges), this account gives you the option to trade without swaps.

In real-life trading scenarios, this is a useful feature if you want to hold positions for longer periods without worrying about the interest rates. It’s particularly helpful if you’re trading forex or gold and want to avoid extra costs over time.

2. HFM Zero Account in South Africa

The HFM Zero Account is designed for traders who want to enjoy tight spreads and low costs when trading forex and commodities like gold. If you’re looking for an account that offers direct market execution, zero spreads, and a wide range of trading instruments, then this account type is ideal for you.

Let’s break down everything you need to know about the HFM Zero Account and how it works in South Africa.

1. Spread Type: Variable (Starting from 0 pips)

The HFM Zero Account offers variable spreads, which means the spread can change depending on the market conditions. The spread starts from 0 pips for both forex and gold trading.

In real-life trading scenarios, this means you can enter and exit trades with no spread cost for the most liquid forex pairs (like EUR/USD or USD/ZAR) and commodities like gold. Essentially, you’ll pay no spread cost, but there might still be a commission for trading forex pairs, which we’ll cover below.

This makes the Zero Account an attractive choice for active traders and scalpers who need tight spreads to execute their strategies effectively.

2. Account Currency: USD and ZAR

With the HFM Zero Account, you can choose between two base currencies: USD (United States Dollar) or ZAR (South African Rand).

If you’re a South African trader, choosing ZAR as your base currency can help you avoid currency conversion fees when you deposit or withdraw funds in Rands. If you choose USD, you’ll be trading in a widely recognized global currency, which can be beneficial for accessing international markets.

Also Read

7 Ways to Make Crypto Analysis Before Buying or Selling in Africa

3. Minimum Deposit: $0 / R0

The HFM Zero Account has a minimum deposit requirement of $0 or R0, meaning you can open the account with no initial deposit.

In real trading terms, this feature allows you to explore HFM in South Africa with zero financial commitment. You can open an account and start practising with demo funds or make a small deposit when you feel ready to begin real trading.

4. Minimum Trade Size: 0.01 Lot

The minimum trade size in the HFM Zero Account is 0.01 lot, which is equivalent to 1,000 units of the base currency.

For example, if you’re trading USD/ZAR with a 0.01 lot position, your trade will be worth $1,000. This allows you to start small and build your positions gradually. In real-life trading, this feature makes the account ideal for both beginners and experienced traders who want to trade with low-risk positions.

5. Maximum Leverage: 1:2000

The HFM Zero Account offers maximum leverage of 1:2000, allowing you to control larger positions with a smaller amount of capital.

For instance, with $1,000 in your account, you can potentially trade up to $2,000,000 worth of positions. However, while high leverage increases your profit potential, it also increases risk, so it’s crucial to have a strong risk management strategy in place.

In real trading, this level of leverage allows you to make the most of market movements, especially if you’re trading more volatile instruments like forex or gold.

6. Commission for Forex Pairs

While the HFM Zero Account offers zero spreads, there is a commission fee on forex pairs. This commission is a small charge for executing trades and is generally applied on a per-lot basis.

In real-life trading, this means that although you don’t pay any spread cost, you’ll still incur a commission for each forex trade. However, since the spread is zero, the overall cost of trading can be lower compared to accounts with wider spreads.

7. Swap-Free Option

The HFM Zero Account is swap-free, which means there are no overnight interest charges for holding positions.

In real trading, this is particularly beneficial if you’re a long-term trader who wants to hold positions for several days or weeks without worrying about extra costs.

It’s also an important feature for traders who follow Islamic finance principles or anyone looking to avoid swap rates on forex or gold positions.

8. Maximum Total Trade Size: 60 Standard Lots per Position

The maximum total trade size in the HFM Zero Account is 60 standard lots per position.

In real-life trading, this allows you to enter larger positions, making it ideal for professional traders who trade significant amounts of capital. For example, if you’re confident in a trade and want to maximize your potential profit, you can open a larger position without restrictions.

9. Max Simultaneous Open Orders: 500

The HFM Zero Account allows you to open up to 500 simultaneous orders at once.

In real-life trading scenarios, this allows you to take advantage of different trading opportunities across multiple markets or trading strategies. You can trade several forex pairs, commodities, or stocks simultaneously, helping you diversify your portfolio.

10. Margin Call: 50% & Stop-Out Level: 20%

The margin call level is 50%, and the stop-out level is 20%.

In real trading, when your account equity drops to 50% of the required margin, you’ll receive a margin call, prompting you to add more funds or close positions. If your equity falls further to 20%, your trades will be automatically closed to prevent further loss.

These levels help you manage risk and protect your capital. For traders in South Africa, these features provide additional security while trading forex and gold.

11. Trading Instruments: All Available Instruments

The HFM Zero Account gives you access to all available instruments, including forex pairs, commodities like gold, stocks, and even cryptocurrencies.

In real-life trading, this means you have the flexibility to trade across various markets. You can take advantage of different market conditions, whether you’re trading EUR/USD, USD/ZAR, or gold. Diversification is key in reducing risk and increasing profit opportunities.

What Does the HFM Zero Account Mean in Real-Life Trading?

In real-life scenarios, you could use the HFM Zero Account to trade popular forex pairs like USD/ZAR with no spread cost, or to buy and sell gold without worrying about additional swap charges. The high leverage allows you to make larger trades, but you should always have a solid risk management plan in place to avoid significant losses.

Also Read

How To Use HF Markets In South Africa

3. HFM Pro Account in South Africa

The HFM Pro Account is designed for traders who are looking for competitive spreads and advanced trading conditions without paying additional commissions. It’s perfect for both beginner traders and experienced professionals who want to access a variety of trading instruments with good execution speeds.

Let’s break down everything you need to know about the HFM Pro Account and how it works in South Africa.

1. Spread Type: Variable (From 0.5 pips)

The HFM Pro Account offers variable spreads, starting from 0.5 pips.

This means the spread (the difference between the buy and sell price) can change depending on market conditions. The starting point of 0.5 pips makes this account ideal for traders who want tight spreads without the extra cost of commissions.

In real-life trading, this is helpful for scalpers or day traders who rely on small price movements to make quick profits. The lower spread helps you get better prices when entering and exiting the market, making it easier to profit.

2. Account Currency: USD and ZAR

You can choose between USD (United States Dollar) or ZAR (South African Rand) as the base currency for your account.

If you’re trading from South Africa, using ZAR as your base currency will save you from currency conversion fees when depositing or withdrawing in Rand. On the other hand, if you prefer a global trading currency, you can choose USD, which is accepted in most international markets.

In real-life scenarios, choosing ZAR may help reduce unnecessary fees when trading in local markets, while USD gives you access to the global forex markets.

3. Minimum Deposit: $100 / R1,800

The minimum deposit required to open an HFM Pro Account is $100 or R1,800.

This is a relatively low initial deposit, which makes the Pro Account accessible for a wider range of traders. In real trading terms, this means you don’t need a lot of capital to start. However, to take full advantage of the 1:2000 leverage and trade higher volumes, you might want to deposit more.

4. Minimum Trade Size: 0.01 Lot

The minimum trade size is 0.01 lot, which means you can trade in very small amounts.

In real-life trading, this allows you to start with very low risk. For instance, trading 0.01 lot in USD/ZAR means you’re controlling a $1,000 position. It’s a great way to practice and gain experience without risking too much capital.

5. Maximum Leverage: 1:2000

The maximum leverage available on the HFM Pro Account is 1:2000.

Leverage allows you to control larger positions with less capital. For example, with $1,000 in your account, you can trade up to $2,000,000 worth of positions. While this can increase your potential for higher profits, it also means you can lose more quickly if trades go against you.

In real-life trading, this feature is ideal for traders who want to make larger trades or take advantage of small market movements. However, always make sure you use proper risk management when trading with high leverage.

6. Commission for Forex Pairs: No

The HFM Pro Account does not charge any commissions on forex pairs.

This is a big advantage for traders who want to keep their costs low. The zero commission means you only pay the spread, which starts at 0.5 pips. So, in real-life trading, you’ll know exactly what you’re paying, without any surprise charges.

7. Swap-Free Option

The HFM Pro Account offers a swap-free trading option, meaning you won’t be charged or credited with any overnight interest on your positions.

This is an important feature for traders who want to avoid swap fees, particularly if they plan on holding positions overnight or longer. For Islamic traders, this feature ensures compliance with Sharia law, as it eliminates interest-based charges.

In real-life scenarios, this can be a major benefit for traders who hold long-term positions in forex or commodities, and want to avoid paying additional fees on their trades.

8. Maximum Total Trade Size: 60 Standard Lots per Position

The maximum total trade size per position on the HFM Pro Account is 60 standard lots.

In real-life trading, this allows you to make larger trades and control bigger positions. For example, you can trade 60 standard lots in USD/JPY or EUR/USD, which means you’re managing significant amounts of capital. This is useful for professional traders who want to enter large positions with a single trade.

9. Max Simultaneous Open Orders: 500

The HFM Pro Account allows you to have up to 500 simultaneous open orders.

In real trading, this means you can open multiple positions across different markets and instruments. You might want to take advantage of multiple trading opportunities, like trading forex, commodities, and stocks at the same time. This flexibility is key for professional traders who want to diversify their portfolio.

10. Margin Call: 50% & Stop-Out Level: 20%

The margin call level for the HFM Pro Account is set at 50%, and the stop-out level is set at 20%.

When your account equity falls to 50% of the required margin, you’ll receive a margin call from HFM. This will prompt you to either add more funds or reduce your positions to avoid a margin close-out. If your equity drops to 20%, your positions will be automatically closed to prevent further loss.

In real-life trading, these levels help protect you from losing all your funds. However, it’s important to manage your trades wisely to avoid margin calls and stop-out situations.

11. Trading Instruments: All Available Instruments

The HFM Pro Account gives you access to all available trading instruments, including forex pairs, commodities (like gold and silver), stocks, and cryptocurrencies.

In real-life trading, this means you can trade a wide variety of assets from different markets. For example, you can trade EUR/USD, USD/ZAR, gold, and even cryptocurrencies all within the same account. This offers you flexibility and diversification in your trading strategy.

What Does the HFM Pro Account Mean in Real-Life Trading?

In real-life trading, this account is well-suited for traders who want to take advantage of short-term market movements or long-term positions without worrying about overnight interest (swap) fees. The ability to trade up to 60 lots per position and manage 500 open orders simultaneously makes the Pro Account perfect for experienced traders or those who want to scale up their trading strategy.

For traders in South Africa, it’s a highly competitive option that can give you the tools you need to succeed in forex and other markets.

4. HFM Pro Plus Account in South Africa

The HFM Pro Plus Account is one of the most advanced account types offered by HFM. It’s designed for experienced traders who need better trading conditions, personalized services, and more control over their trading strategy. If you’re based in South Africa and want to take your trading to the next level, the Pro Plus Account might be exactly what you need.

This account is ideal for those who are serious about trading and want to access lower spreads, greater leverage, and more flexibility in their positions.

Let’s break down what the HFM Pro Plus Account offers and how it could benefit you in real-life trading scenarios.

1. Spread: From 0.2 Pips

The HFM Pro Plus Account offers ultra-tight spreads starting from just 0.2 pips. This is one of the most attractive features for traders who want to minimize the cost of opening and closing trades.

In real-life trading, a spread of 0.2 pips means you pay a very small fee when buying and selling currency pairs. For example, if you trade EUR/USD, the cost between buying and selling is minimal, allowing you to make profits even from small market movements. This is particularly useful if you are a scalper or day trader who needs to execute many trades in a short period.

2. Minimum Deposit: $250 / R4,700

To open a HFM Pro Plus Account, you need a minimum deposit of $250 (or about R4,700 if you’re in South Africa). This is a moderate amount for traders who want professional trading conditions without committing a large sum upfront.

In real-life trading, the $250 deposit is enough to open and manage trades with a larger margin compared to Cent Accounts. This deposit allows you to access more advanced features like tighter spreads and higher leverage while still keeping your risk level manageable.

3. Leverage: Up to 1:2000

The HFM Pro Plus Account offers high leverage up to 1:2000, which means you can control a large position with a relatively small investment.

For example, if you deposit $250, you can potentially trade up to $500,000 worth of positions. This high leverage can significantly increase your potential profits, but it also increases the risks, as even small market movements can have a big impact on your account balance.

In real-life scenarios, this means you can take larger positions with a small deposit, making it perfect for active traders in South Africa who want to take advantage of market volatility.

4. Trading Instruments: All Available Instruments

With the HFM Pro Plus Account, you have access to a wide range of trading instruments. This includes forex pairs, commodities, stocks, and even cryptocurrencies.

In real-life trading, this gives you the ability to diversify your trading strategy. For instance, you might trade forex pairs like EUR/USD, USD/ZAR, or GBP/USD, while also taking positions in commodities like gold and oil, or even stocks and Bitcoin. Diversifying across different assets helps you reduce the risk of focusing on just one market.

5. Minimum Trade Size: 0.01 Lot

The HFM Pro Plus Account allows a minimum trade size of just 0.01 lot. This is ideal for traders who want to manage their positions more precisely without committing too much capital per trade.

In real-life scenarios, trading in small lot sizes like 0.01 lots allows you to test your strategies with minimal risk. For example, if you’re experimenting with a new trading strategy, you can open small positions to learn how the market behaves without risking your entire account balance.

6. No Commission on Forex Pairs

One of the advantages of the HFM Pro Plus Account is that it does not charge a commission on forex trades. Instead, you only pay for the spread, which starts from 0.2 pips.

This is great for forex traders in South Africa who want to execute trades without worrying about paying extra commission fees. Since the spread is already tight, you’re essentially only paying for the market’s cost to open and close positions, making it cost-efficient, especially for frequent traders.

7. Margin Call Level: 50%

The margin call level for the HFM Pro Plus Account is set at 50%. This means if the value of your account falls to 50% of the required margin for your open trades, you’ll get a warning to add more funds or close some positions.

For example, if the market moves against you and your equity drops by 50%, you’ll receive a margin call alert. This gives you a chance to either deposit more funds or close some trades to avoid a stop-out.

8. Stop Out Level: 20%

The stop-out level for the HFM Pro Plus Account is set at 20%. When your account equity falls below 20% of the required margin for your trades, HFM will automatically close your positions to prevent further losses.

For instance, if your account balance drops too low, HFM will close your trades to protect your capital. This feature acts as a safety net for traders who don’t want to lose more than their deposited funds.

9. Maximum Total Trade Size: 60 Standard Lots per Position

With the HFM Pro Plus Account, you can trade up to 60 standard lots per position. This is ideal for traders who want to take large positions and maximize their exposure in the market.

In real-life trading, this means you can execute larger trades, which is particularly useful if you are a professional trader or have a significant trading strategy in mind. For example, if you’re confident in a market move, you can place a large position without worrying about the limit on trade size.

10. Max Simultaneous Open Orders: 500

The HFM Pro Plus Account allows you to open up to 500 simultaneous orders. This gives you flexibility to trade multiple positions in various markets at the same time.

In real-life trading, you might be trading several instruments across different asset classes, such as forex pairs, commodities, and stocks. The ability to open many orders at once is useful for traders who follow diverse strategies and need to manage many positions simultaneously.

11. Personalized Service: Yes

One of the standout features of the HFM Pro Plus Account is the personalized service. This means you’ll get a dedicated account manager who is there to assist you with your trading needs.

In real-life scenarios, this is extremely helpful for traders who need advice on strategies, market conditions, or specific technical issues. Having a personalized account manager can make a huge difference in how you approach trading, especially if you’re new to the platform or need guidance on optimizing your trades.

12. Swap-Free Option: Yes

The HFM Pro Plus Account also offers a swap-free option. This is ideal for traders who want to avoid paying interest on overnight positions, making it suitable for those who want to trade according to Islamic principles or prefer not to deal with swap rates.

What Does the HFM Pro Plus Account Mean in Real-Life Trading?

The HFM Pro Plus Account is perfect for experienced traders in South Africa who need advanced trading features, tighter spreads, and greater flexibility. With a minimum deposit of $250, you can take advantage of low-cost trading with 0.2 pip spreads and access a wide range of trading instruments.

The high leverage of 1:2000 allows you to control larger positions with a smaller deposit, but it’s important to manage the risk that comes with it. The swap-free option and personalized service make it an attractive choice for traders who want a more tailored experience.

In real-life trading scenarios, the Pro Plus Account gives you the tools to manage multiple positions, maximize your trading opportunities, and receive expert assistance from a dedicated account manager.

Also Read

HF Markets Review for African Traders

5. HFM Premium Account in South Africa

The HFM Premium Account is designed for traders who want a more advanced trading environment but don’t necessarily need the extreme features of the Pro Plus or Pro Accounts. This account type offers solid trading conditions, access to all instruments, and the ability to trade with high leverage. If you’re a trader in South Africa looking for a balanced account with good spreads and flexibility, the HFM Premium Account could be a great fit for you.

Let’s go over the key details of the HFM Premium Account and explain what it would mean in real-life trading scenarios.

1. Spread: From 1.2 Pips

The HFM Premium Account offers variable spreads, starting from 1.2 pips. A spread is the difference between the buy and sell prices of a currency pair. A 1.2 pip spread means that when you trade popular forex pairs like EUR/USD, you’ll be paying a relatively low cost to open and close a position.

In real-life trading scenarios, this spread is suitable for traders who don’t need ultra-tight spreads (like the Pro Plus Account) but still want competitive trading costs. For example, if you’re trading with $100, the cost of entering and exiting a trade with a 1.2 pip spread is manageable and won’t eat into your profits too much.

2. Minimum Deposit: $0 / R0

The minimum deposit for the HFM Premium Account is $0 (or R0 in South African Rand), meaning you can technically open the account without any initial deposit. This is great for traders who want to explore HFM in South Africa without committing any funds upfront.

However, while there’s no required deposit to open the account, it’s recommended to deposit some funds to start trading. For example, you may choose to start with $250 (around R4,700) to take full advantage of the leverage and start executing trades.

3. Leverage: Up to 1:2000

Like other HFM accounts, the Premium Account offers high leverage up to 1:2000. This means that with $250, you can trade up to $500,000 in positions, making it a great option for traders who want more control over their trades without needing a huge deposit.

In real-life trading scenarios, this high leverage gives you the ability to amplify both your profits and losses. For example, if the market moves in your favour, you could earn significantly more than with a lower leverage, but be mindful that if the market moves against you, the losses can also be much higher. Risk management is key when trading with high leverage.

4. Trading Instruments: All Available Instruments

The HFM Premium Account gives you access to all available trading instruments. You can trade forex pairs, commodities, stocks, cryptocurrencies, and much more.

In real-life trading, this means you have wide market exposure. For example, you can trade EUR/USD if you’re focused on forex, or gold and oil if you’re interested in commodities. If you want to try something more modern, you can also trade cryptos like Bitcoin. This diversity allows you to spread your risk and trade based on your preferences.

5. Minimum Trade Size: 0.01 Lot

With the HFM Premium Account, you can trade small positions with a minimum trade size of 0.01 lot. A lot refers to the volume or size of a trade, and 0.01 lot is the smallest possible position.

In real-life trading, this gives you the flexibility to trade with small amounts of capital. For example, if you deposit $250, you can trade smaller positions, which is great for beginners who want to start small and gradually increase their exposure as they become more experienced.

6. Commission for Forex Pairs: No

One of the great things about the HFM Premium Account is that it does not charge commissions for forex pairs. Instead, your cost comes from the spread (starting from 1.2 pips), which makes it more transparent for traders.

In real-life scenarios, this means you don’t have to worry about extra commission fees, which can add up, especially if you’re trading frequently. All you pay is the spread, and since the spreads are relatively low compared to some other brokers, it keeps your costs in check.

7. Margin Call Level: 50%

The margin call level is set at 50% for the HFM Premium Account. This means if your account balance falls to 50% of the margin required for your open positions, you will receive a margin call to either deposit more funds or close some trades.

For example, if you’ve opened positions with $250 and the market moves against you, once your equity drops to 50% of the margin, you’ll get a notification. This helps you stay alert and make the necessary adjustments to avoid losing more money.

8. Stop Out Level: 20%

The stop-out level for the HFM Premium Account is set at 20%. This means if your account balance falls to 20% of the required margin for your positions, HFM will automatically close your trades to protect you from further losses.

In real-life scenarios, the stop-out level serves as a protection mechanism. For example, if the market moves drastically against your positions, and you don’t have enough funds to maintain them, the system will close them to prevent your account from going into negative balance.

9. Maximum Total Trade Size: 60 Standard Lots per Position

The HFM Premium Account allows you to trade up to 60 standard lots per position. This gives you plenty of room to execute larger trades if needed.

In real-life trading, this is particularly useful for professional traders or those who want to trade large volumes without hitting any limits. Whether you’re trading forex or commodities, the ability to place large orders means you can potentially capture bigger market movements with significant positions.

10. Max Simultaneous Open Orders: 500

The HFM Premium Account lets you open up to 500 simultaneous orders. This is a good feature for active traders who want to manage many positions at once.

For example, you could trade different forex pairs, stocks, and even cryptos at the same time. Having the ability to open many trades at once gives you more freedom in how you structure your portfolio.

11. Personalized Service: Yes

Like the Pro Plus Account, the HFM Premium Account also includes personalized service. You will have access to a dedicated account manager who can assist you with your trading needs, whether it’s about trading strategies, account-related issues, or technical support.

In real-life scenarios, having a personal account manager is helpful for getting the most out of your trading experience. You can reach out for tailored advice or if you need help making informed decisions, especially during volatile market conditions.

12. Swap-Free Option: Yes

The HFM Premium Account also offers a swap-free option. This is ideal for traders who prefer to avoid swap rates for holding positions overnight, making it a good choice for those who follow Islamic finance principles or simply don’t want to deal with overnight charges.

What Does the HFM Premium Account Mean in Real-Life Trading?

The HFM Premium Account is perfect for traders in South Africa who want competitive trading conditions with tight spreads, high leverage, and no commissions on forex trades. With a starting deposit of $0, you have the freedom to try out the account and start trading with low-cost entry.

In real-life trading scenarios, the HFM Premium Account gives you the ability to execute trades on a wide range of instruments with tight spreads starting from 1.2 pips.

The high leverage, personalized support, and swap-free options make it an attractive choice for both new traders and experienced professionals. It gives you the tools to grow your trading strategy and manage multiple trades with ease.

What is the Best HFM Account for Beginners in South Africa?

For beginners in South Africa who are looking to start their trading journey, the HFM Cent Account is one of the best options. Here’s why:

1. Minimum Deposit: $0

The HFM Cent Account has a minimum deposit requirement of $0, which means you don’t need to risk a lot of money to get started. This makes it perfect for beginners who are just learning and want to test the waters before committing significant capital.

For example, if you want to practice without risking much, you can open the account with no deposit and then fund it with a small amount later on, like $10 or $50.

2. Low Minimum Trade Size: 0.01 Lot

The HFM Cent Account allows you to trade with a minimum trade size of 0.01 lot. This is particularly important for beginners because it means you can trade with small amounts and manage risk more effectively.

If you deposit $50, for instance, you can open tiny positions that allow you to learn and adjust your strategy without risking large amounts of money.

3. High Leverage: Up to 1:2000

The HFM Cent Account offers high leverage up to 1:2000, meaning you can control larger positions with a small deposit. For example, with just $50, you can trade up to $100,000 worth of assets.

While this is powerful, it also comes with increased risk, so beginners should always use stop-loss orders and ensure proper risk management to protect their capital.

4. No Commission for Forex Pairs

The HFM Cent Account does not charge any commission on forex pairs, making it easier for beginners to understand the costs involved in trading. Instead, the cost comes from the spread, which starts from 1.2 pips.

A spread is the difference between the buying and selling price of a currency pair, and 1.2 pips is quite competitive, meaning that it won’t eat into your profits too much when you enter or exit a trade.

5. Access to Popular Trading Instruments

The Cent Account gives you access to forex and gold, which are two of the most traded instruments in the world. As a beginner, these two markets are a great place to start because they are liquid and have plenty of market analysis resources available. You can start by trading popular currency pairs like EUR/USD and GBP/USD and then gradually expand to gold trading.

6. Swap-Free Option

The HFM Cent Account offers a swap-free option, which is especially beneficial for beginners who want to avoid overnight fees when holding positions for longer periods. A swap is a fee or interest charged for keeping a position open overnight, and with a swap-free account, you can focus purely on the market’s movement without worrying about additional charges.

How the HFM Cent Account Works in Real-Life Scenarios

In real-life trading, the HFM Cent Account provides a low-risk environment where you can learn the basics of trading while still having access to some of the best trading features.

For example:

- You start with a small deposit of $50.

- You open 0.01 lot positions on EUR/USD.

- The spread is 1.2 pips, so your entry and exit cost will be minimal.

- You use 1:2000 leverage, which amplifies your potential gains or losses, but you can always manage risk through the stop-loss and take-profit tools.

With the Cent Account, you’re not going to risk a lot of money on any given trade, and you can learn the trading process without a huge financial commitment. Over time, as you gain more experience, you can increase your trade size and deposit more funds.

How to Open an Account with HF Markets in South Africa (Step-by-Step Guide with Screenshots)

Opening an account with HF Markets (HFM) is easy and can be done in a few simple steps. This guide will walk you through the process, including everything you need to get started and the required information. Let’s begin!

Step 1: Go to the HF Markets Website and Start Registration

- Visit the official HF Markets website. Once there, look for the green “Register” button located at the top right of the page.

- Click on the “Register” button to start the registration process.

Select Your Account Type:

You will be prompted to choose from different account options. You can open an Individual, Corporate, or Joint account. For most traders, especially beginners, the Individual account is the most suitable option.

Complete the Registration Form:

You will now need to fill in a form with the following details:

- Country of Residence: Select South Africa from the dropdown menu (or your current country if you’re not based in South Africa).

- Email Address: Enter a valid email address that you can easily access.

- Create a Strong Password: Ensure your password is secure. It must be between 8 to 15 characters, containing at least one uppercase letter, one lowercase letter, one number, and one special character.

- Accept Privacy Policy: Tick the box confirming you’ve read and agree to HF Markets’ privacy policy.

Once the form is filled out, click the “Register” button to proceed.

Step 2: Verify Your Email Address

- After registering, you’ll receive a 6-digit activation code from HF Markets in your email inbox.

- Open the email and copy the 6-digit code. This code is valid for 5 minutes, so make sure to use it quickly.

- Go back to the HF Markets website and paste the activation code into the verification field.

- Click “Verify” to confirm your email address.

Once your email is verified, HF Markets will show a confirmation message that your email address has been successfully verified. Your account setup is now in progress and will be automatically redirected once it’s completed.

Step 3: Complete Your Profile Information

- Now, you’ll be asked to complete your profile by providing more personal information. This includes:

Enter Personal Information:

- First Name and Last Name: Enter your full name exactly as it appears on your official identity documents.

- Gender: Select your gender.

- Country of Birth: Choose the country where you were born.

- Phone Number: Provide a valid phone number for contact.

- Date of Birth: Select your birth date from the dropdown.

Choose Your Account Currency:

- Select your preferred currency for your account. Options include USD, ZAR, and other major currencies.

Provide Address Details:

- Province/State and Town/City: Enter your region and city where you currently reside.

Additional Information:

- Referral Information: Let HF Markets know how you discovered them.

- Confirm Tax Status: Check the box confirming that you are not a U.S. tax resident.

- Accept Terms and Conditions: Check the box agreeing to HF Markets’ terms and conditions.

After filling out these details, click the “Continue” button to proceed.

Step 4: Choose Your Trading Account Type

- After email verification and profile completion, HF Markets will prompt you to choose the type of trading account you wish to open.

- You will be able to select from various account types depending on your trading needs (e.g., Cent Account, Zero Account, Pro Account, etc.).

- Once you select the account type that suits you, follow the on-screen instructions to complete the setup.

FAQs on HFM Account Types in South Africa

1. What does HFM do?

HFM (HF Markets) is a global online broker that offers trading in various financial instruments such as Forex, commodities, indices, and cryptocurrencies. HFM provides a wide range of account types, including Cent, Zero, Pro, and Premium accounts to cater to different trading needs.

In South Africa, traders can open an HFM account, access powerful trading platforms like MetaTrader 4 and MetaTrader 5, and start trading with competitive spreads and high leverage.

2. Is HFM legit in South Africa?

Yes, HFM (HF Markets) is a legitimate broker in South Africa. They are regulated by multiple authorities, including the Financial Sector Conduct Authority (FSCA) in South Africa. This ensures that HFM operates under strict financial standards, providing a secure and transparent trading environment for traders.

You can start trading on HFM in South Africa with peace of mind knowing that your funds are safe and that the platform adheres to global regulations.

3. Does HFM offer a cent account?

Yes, HFM offers a Cent account as part of its suite of account types for South Africans. The HFM Cent account is designed for beginners or traders who prefer to trade with smaller amounts.

The minimum deposit is $0, and you can start trading with as little as 0.01 lot. This account allows you to practice trading with virtual funds and gain valuable experience before transitioning to larger trades.

4. How much is 1 lot in cent account?

In the HFM Cent account, 1 lot is equivalent to 1,000 units of the base currency. For example, if you are trading Forex, a 1 lot trade would represent 1,000 units of the currency you’re trading. This allows traders to start small and scale up gradually as they gain more experience in the market.

5. What is the minimum deposit in HFM in ZAR?

The minimum deposit to open an account with HFM in South Africa can vary depending on the account type. For example:

- The Cent account has a minimum deposit of $0 (or R0).

- The Zero account also has a $0 minimum deposit (or R0).

- The Pro account requires a minimum deposit of $100 (around R1,800).

- The Premium account has no minimum deposit requirement (or R0).

6. Does HFM have a zero spread account?

Yes, HFM offers a Zero Spread account as part of its account types for South Africans. This account is perfect for traders who prefer tighter spreads and are willing to pay a small commission.

The HFM Zero account offers spreads starting from 0 pips on Forex and gold, making it an excellent option for more experienced traders who want to trade with minimal cost.

7. What is the minimum deposit for HFM zero account?

The minimum deposit for the HFM Zero account is $0 (or R0). This makes it accessible for traders who want to start trading with zero spread without needing to make a large upfront investment. It’s an ideal choice for traders looking for low trading costs and high leverage.

8. How much commission does HFM charge on a zero spread account?

The HFM Zero account charges a commission for Forex pairs. While the spreads are zero, the broker compensates for this with a small commission on each trade.

The commission is generally lower compared to standard account types, but it helps maintain the broker’s tight pricing structure. You can check the exact commission rates in your HFM trading account when you start trading.

9. What is a pro trading account?

A Pro trading account on HFM is an advanced account type designed for more experienced traders. The HFM Pro account offers competitive spreads starting from 0.5 pips and allows trading across all available instruments, including Forex, commodities, and indices.

It also offers high leverage (up to 1:2000) and low commission costs, making it a popular choice for traders who are looking for more flexibility and cost-efficient trading conditions.

10. What is the minimum deposit for HFM pro account?

The minimum deposit for the HFM Pro account is $100 (or approximately R1,800). This account type offers tighter spreads starting at 0.5 pips and is suited for traders who want more advanced trading conditions. If you’re looking to start trading on HFM in South Africa with a Pro account, this is the minimum amount you need to begin.

11. What is the minimum deposit for HFM premium account?

The minimum deposit for the HFM Premium account is $0 (or R0). This means that you can open a Premium account with no initial deposit, giving you the flexibility to start trading without a large upfront investment. The Premium account provides access to various instruments and platforms, along with personalized services and a dedicated account manager.

12. What is a premium trading account?

A Premium trading account on HFM is designed for traders who require more personalized services. It provides features like tight spreads, high leverage, and access to advanced trading tools. The Premium account offers a high level of customer support, including a personal account manager, and is perfect for those who want to enhance their trading experience with HFM in South Africa.

13. How many account types are in HFM?

HFM offers 5 main account types:

- Cent Account – Ideal for beginners with smaller trades and lower risk.

- Zero Account – Features zero spreads with a small commission on trades.

- Pro Account – Offers tight spreads starting from 0.5 pips and high leverage for advanced traders.

- Pro Plus Account – Similar to the Pro account, but with even tighter spreads starting from 0.2 pips.

- Premium Account – Designed for experienced traders who need personalized services and better trading conditions.

14. How to open an HFM account in South Africa?

To open an HFM account in South Africa, simply follow these steps:

- Go to the official HFM website and click on “Register”.

- Fill in your personal details, such as your name, email address, and country of residence.

- Select the account type you want (e.g., Cent account, Pro account, etc.).

- Complete your profile and upload any required documents for verification.

- Deposit the minimum amount required (depending on the account type).

- Start trading on the HFM platform.

15. Does HFM offer demo accounts in South Africa?

Yes, HFM offers demo accounts in South Africa. These demo accounts allow you to practice trading with virtual funds on real market conditions. It’s an excellent way for beginners to familiarize themselves with HFM’s trading platforms like MetaTrader 4 and MetaTrader 5 without any financial risk.

You can create a demo account when signing up for an HFM account, and use it to test various strategies and tools before trading with real money.

Our telegram group is now open to the public. Get instant access to future posts and tutorials on HFM in South Africa.